Fish Hook Chart Pattern

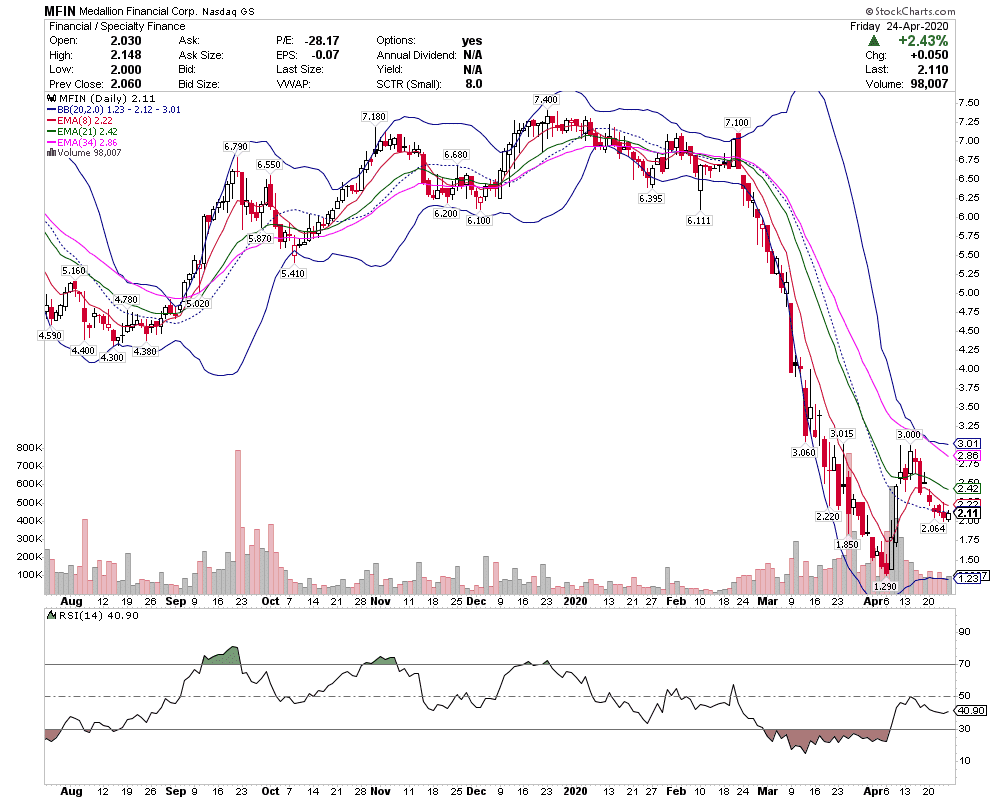

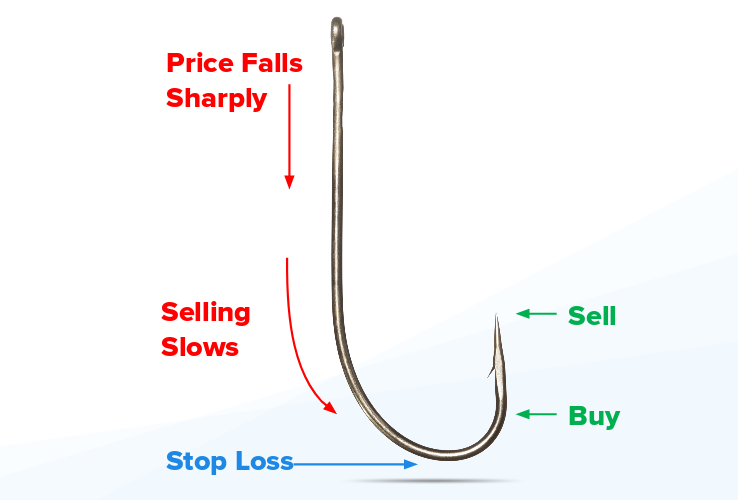

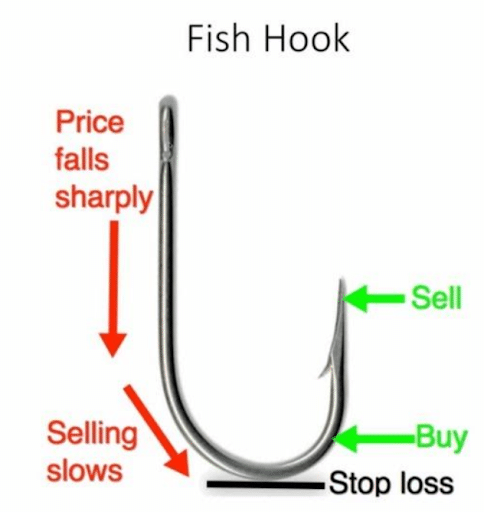

A fishhook formation is named because of the shape of the indicator as it forms in the chart.

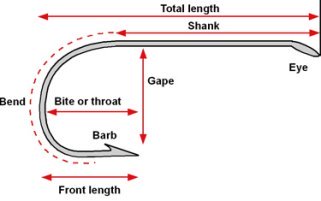

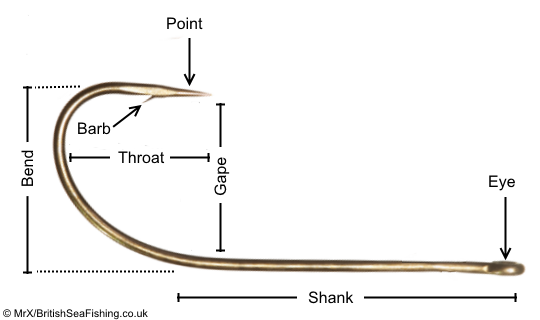

Fish hook chart pattern. Bend the bend is exactly like it sounds. A cross between a longline hook and a wide gap or kahle. The recurve design ensures most fish are hooked in the corner of the mouth.

It is the link between your line and the hook. Eye the eye is where you attach your fishing line or leader to. Leave the drag on and fish hook themselves.

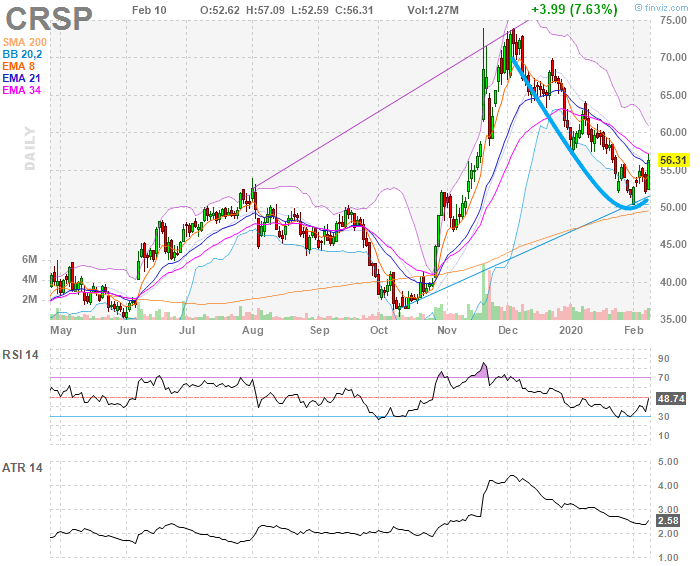

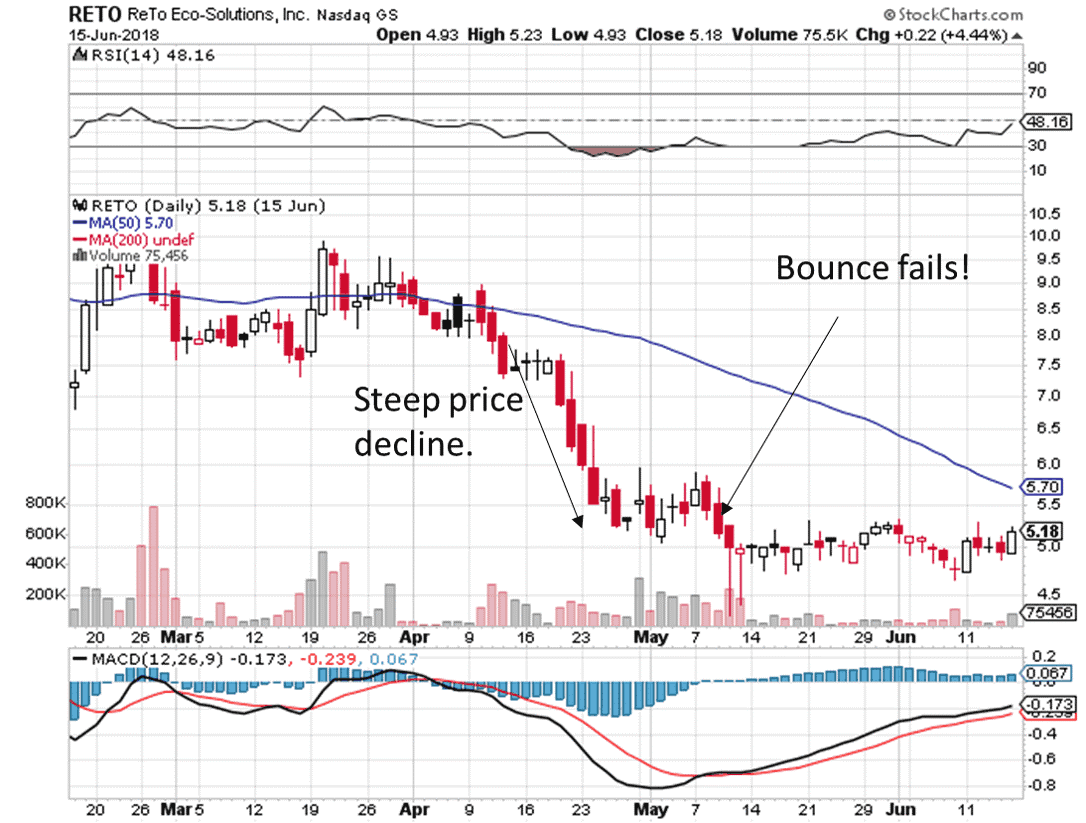

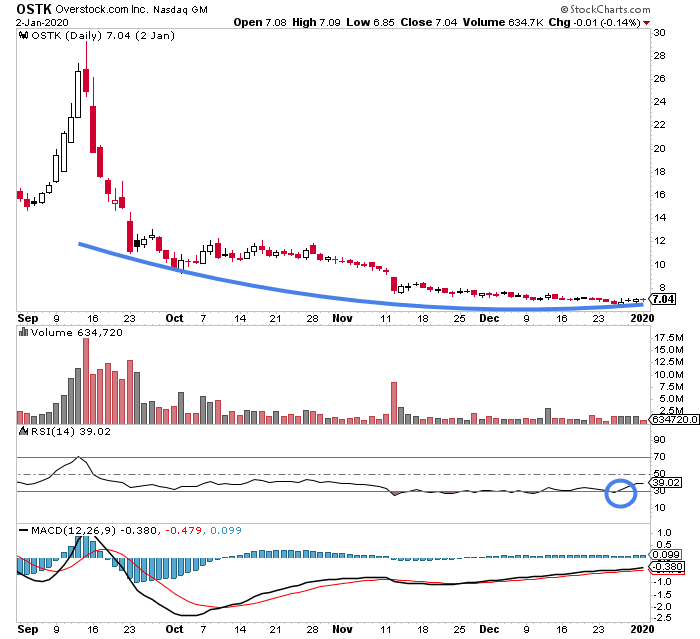

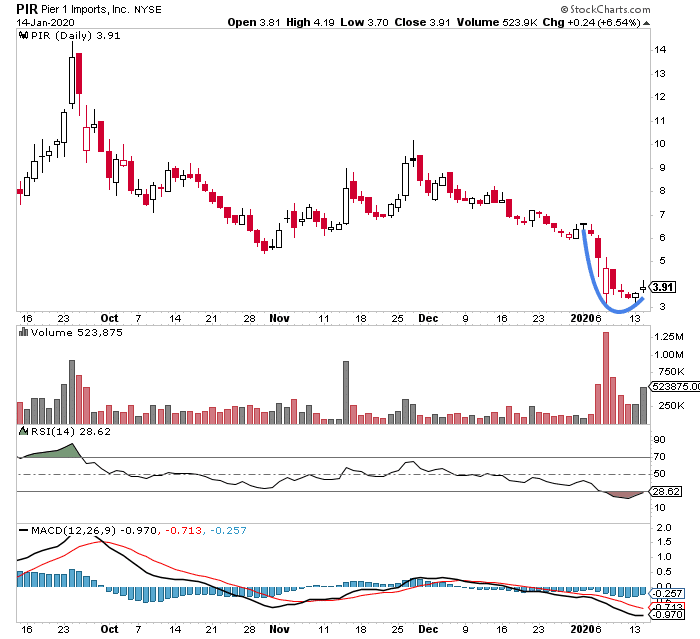

Learn more about the jason bond 3 trading strategies for free here. 2 the stock finds an area where it has a hard time breaking below. But remember we like to pair the chart pattern with catalysts and an area of value.

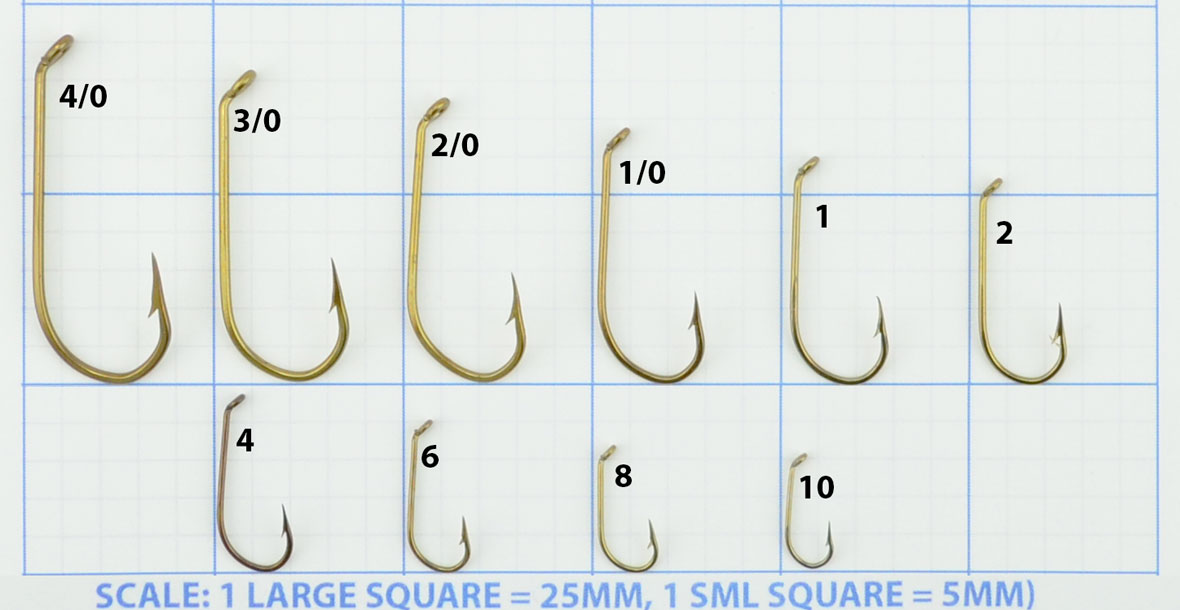

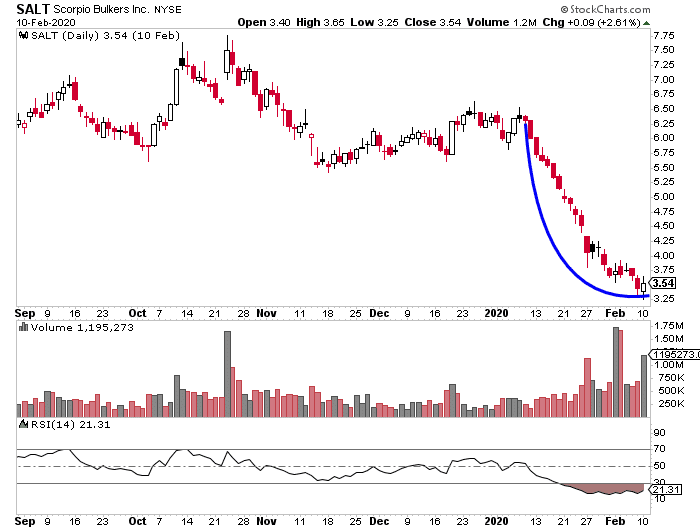

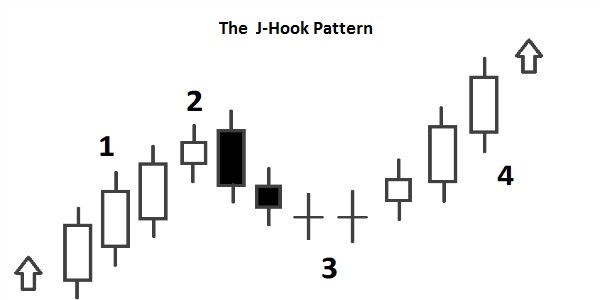

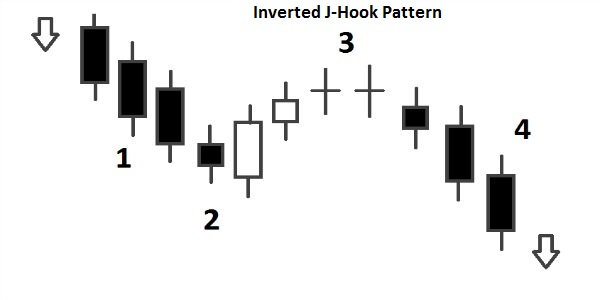

Check out the picture below that demonstrates the basic idea of the fish hook trading pattern. 1 a steep drop in price. This is one of the most reliable chart patterns you will find.

They are important to us when they occur because the represent a moment of turmoil and potentially of great energy about to be unleashed. With the fish hook pattern there are a few things we re looking for. It is the.

I call this chart pattern the fish hook pattern. However pti actually released data regarding one of the treatments in its pipeline on march 25 which is where you see the big gap down. Fishhook formations occur in first derivative indicators like a price oscillator or summation index.

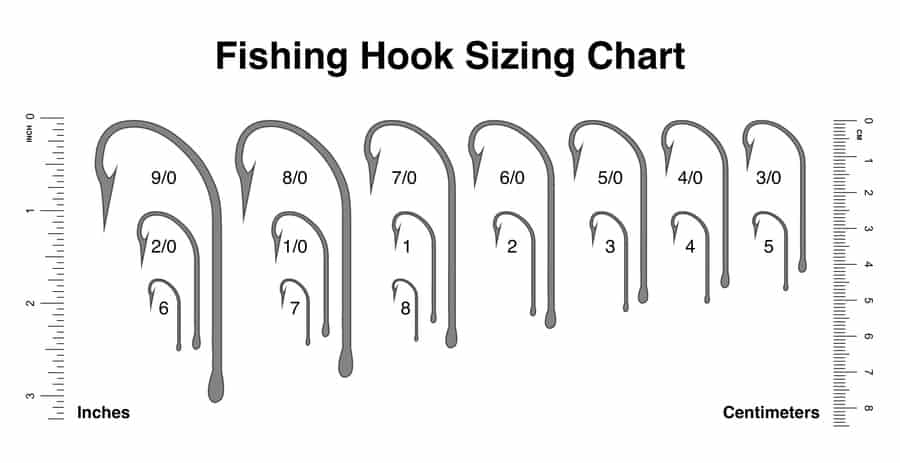

Here s a look at the daily chart on pti from finviz. Size 06 04 02 01 small 15 14 13 12 economy 34 32 30 28. That in mind the pattern is pinned due to outlook for example the bear flag pattern may be in the cards here.

Shank the shank is the longest part of the hook liken it to your femur bone and provides much of the strength and. Here s a look at the daily chart on tsla. Yes it s clearly a fish hook pattern.

:max_bytes(150000):strip_icc()/continuationpatternexamples-b172a4918c5b4191a12fd56fbed288cb.jpg)

:max_bytes(150000):strip_icc()/IO-Chart-02152019-5c66c9584cedfd00014aa38e.png)

/MFR011_v2_MustadConicalPoint_2001-56da215f3df78c5ba039773c.jpg)