Earned Income Credit Table 2017 Chart

This is not a tax table.

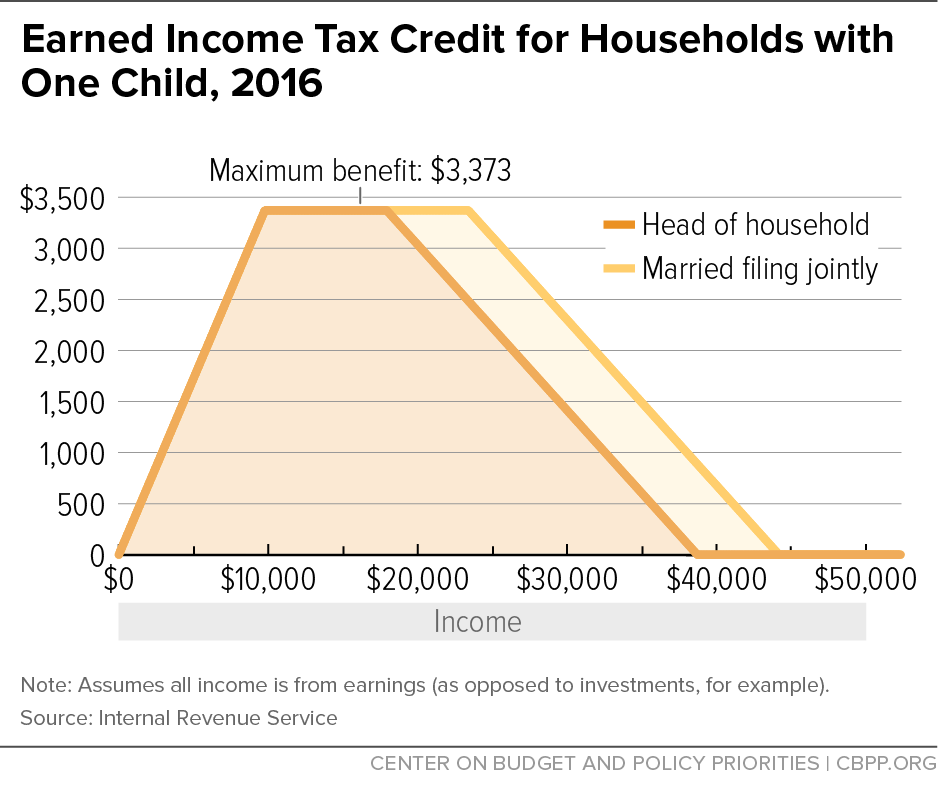

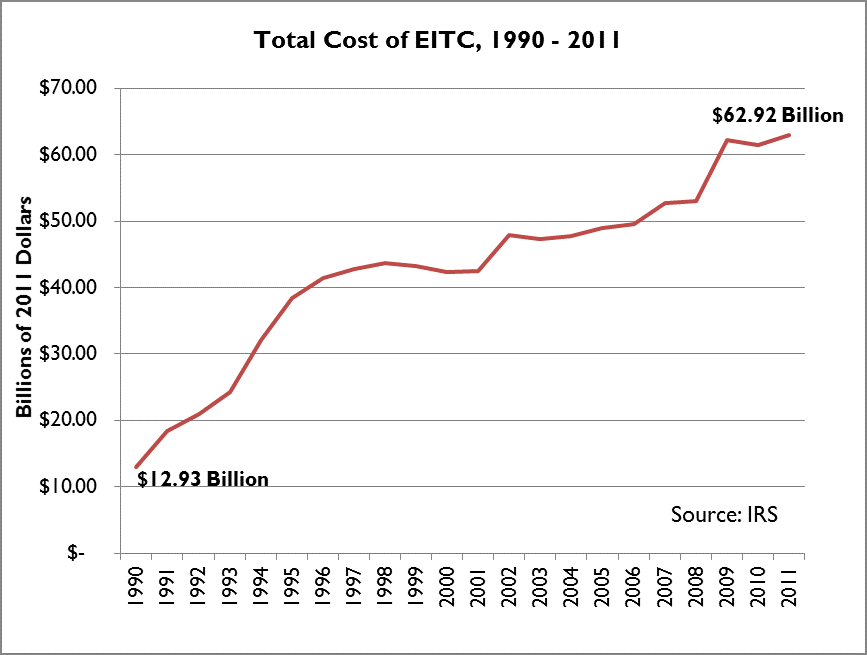

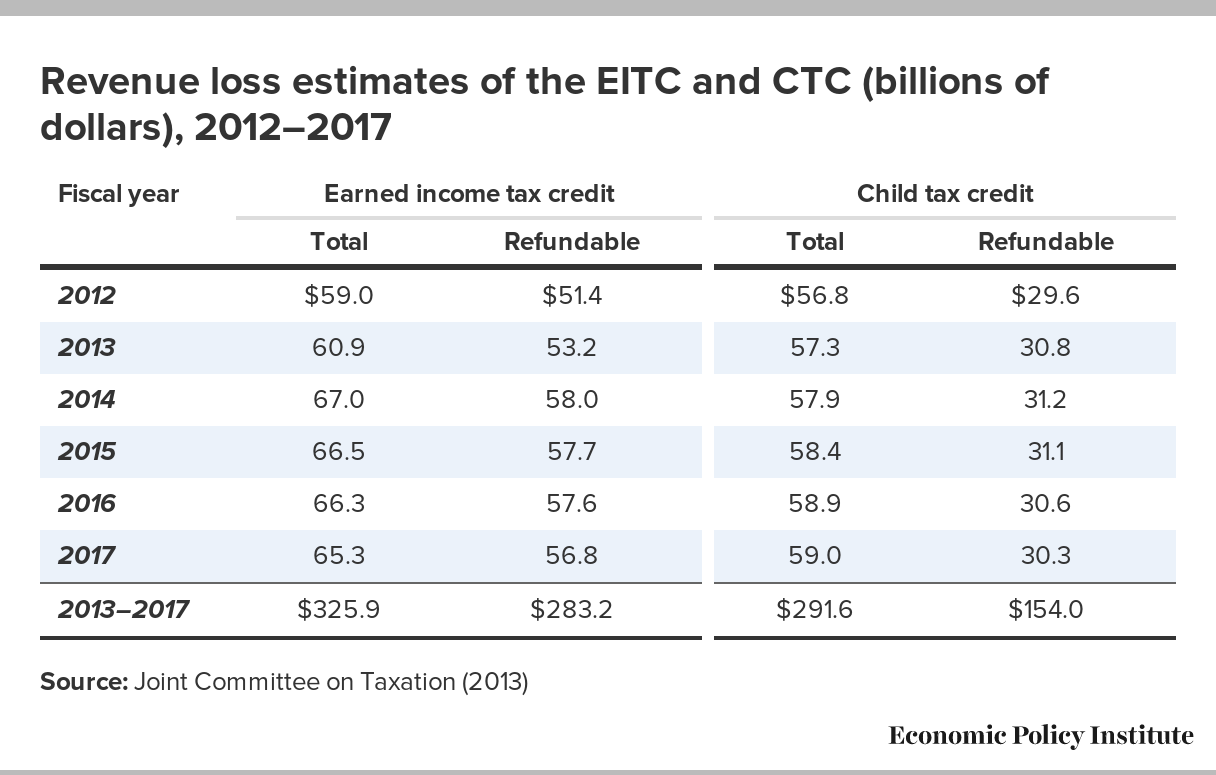

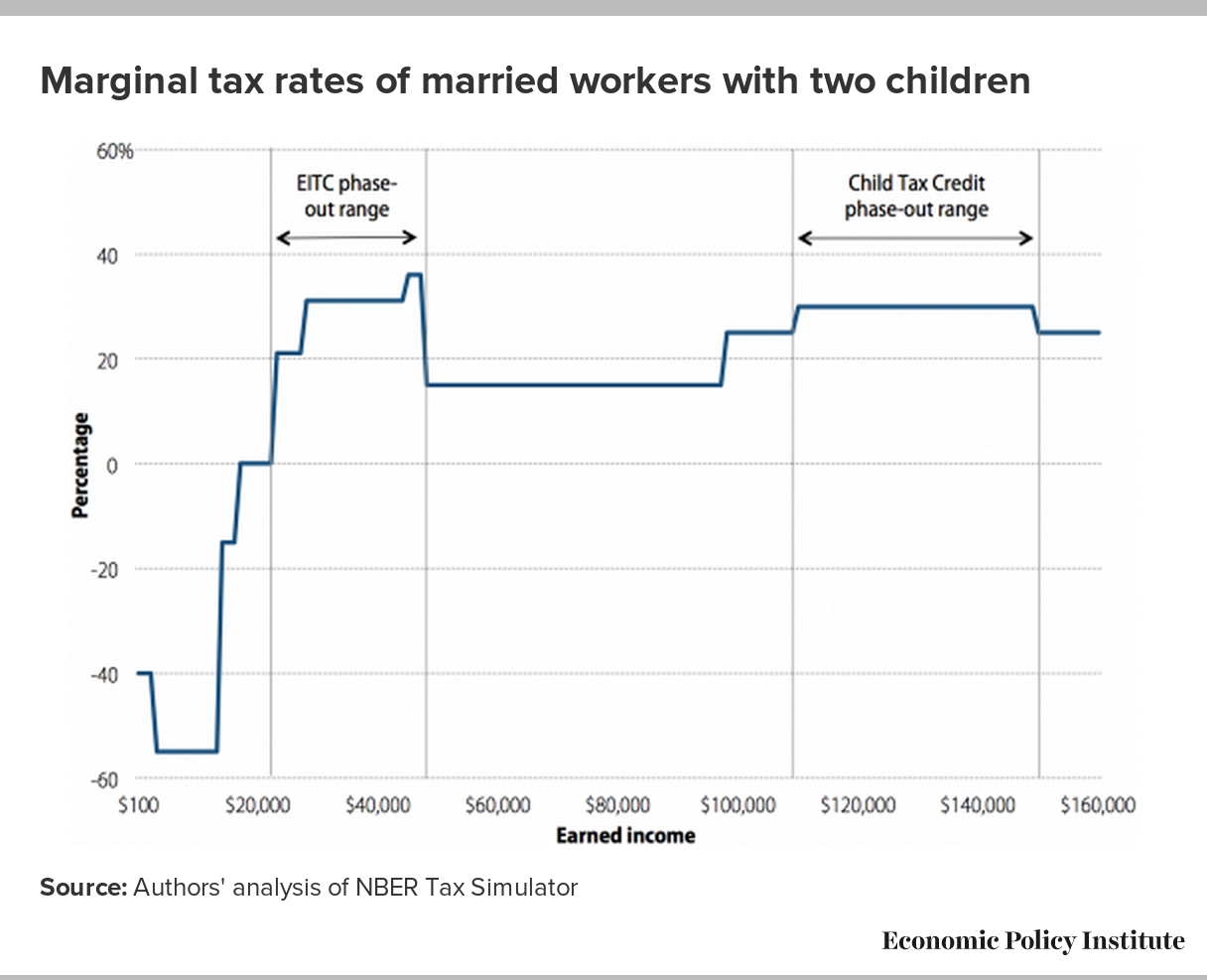

Earned income credit table 2017 chart. The earned income credit eic is a tax credit for certain people who work and have earned income under 53 930. See the earned income and adjusted gross income agi limits maximum credit for the current year previous years and the upcoming tax year. Topic page for 2017 eic table.

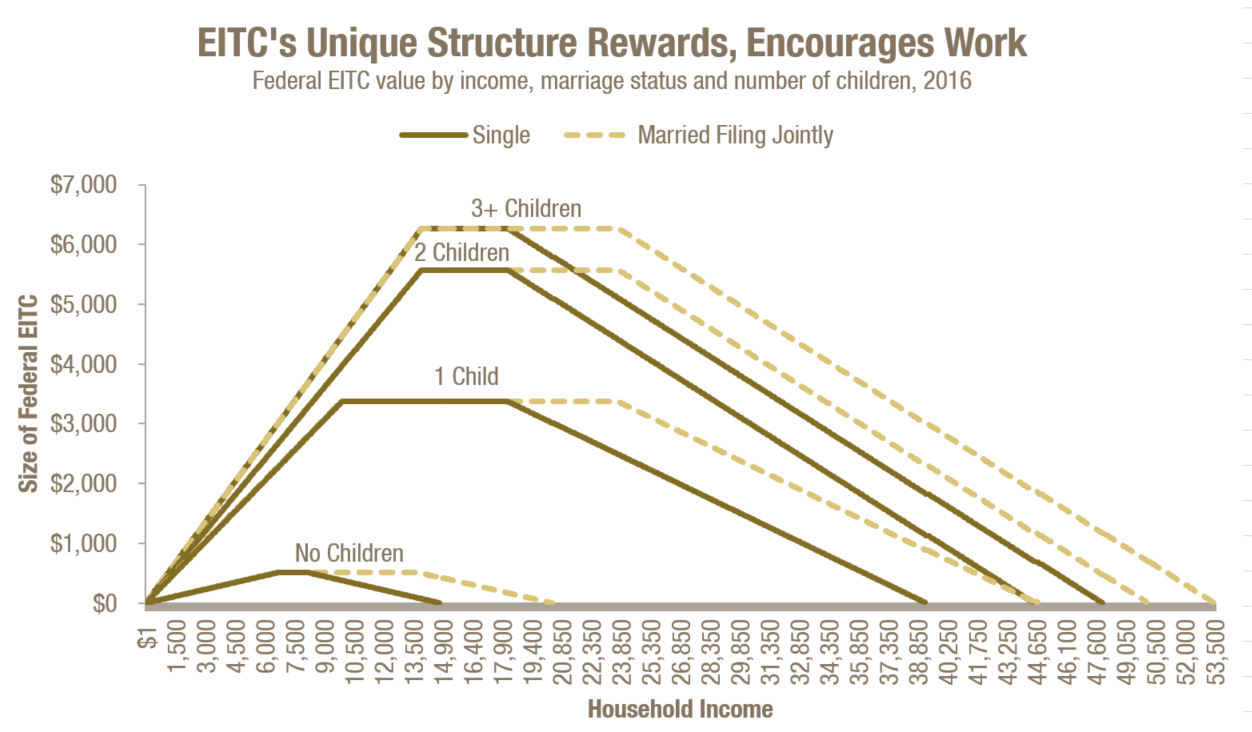

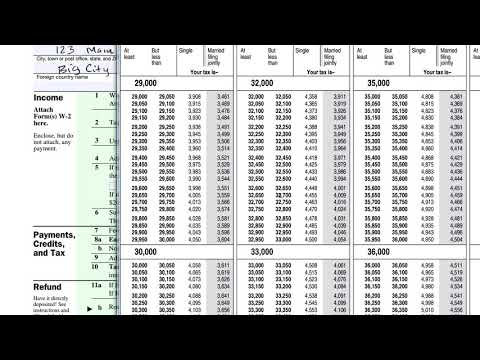

These rules are summarized in table 1. Publication 596 earned income credit 2017 earned income credit eic table. Then go to the column that includes your filing status and the number of qualifying children you have.

This is not a tax table. See earned income tax credit eitc income limits and maximum credit amounts. 2019 earned income credit 50 wide brackets 6 12 19 if the if the if the amount you and you listed amount you and you listed amount you and you listed are looking up are looking up are looking up from the one two three no from the one two three no from the one two three.

2018 earned income credit eic table caution. Single head of household or widowed. Then go to the column that includes your filing status and the number of qualifying children you have.

If filing zero one two three. Can i claim the eic. To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet.

2017 earned income credit eic table caution. To claim the eic you must meet certain rules. To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet.

/how-does-the-social-security-earnings-limit-work-2388828_FINAL-2a648bdf8bc84b318a1e116131459238.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)